Corporate Profile

I

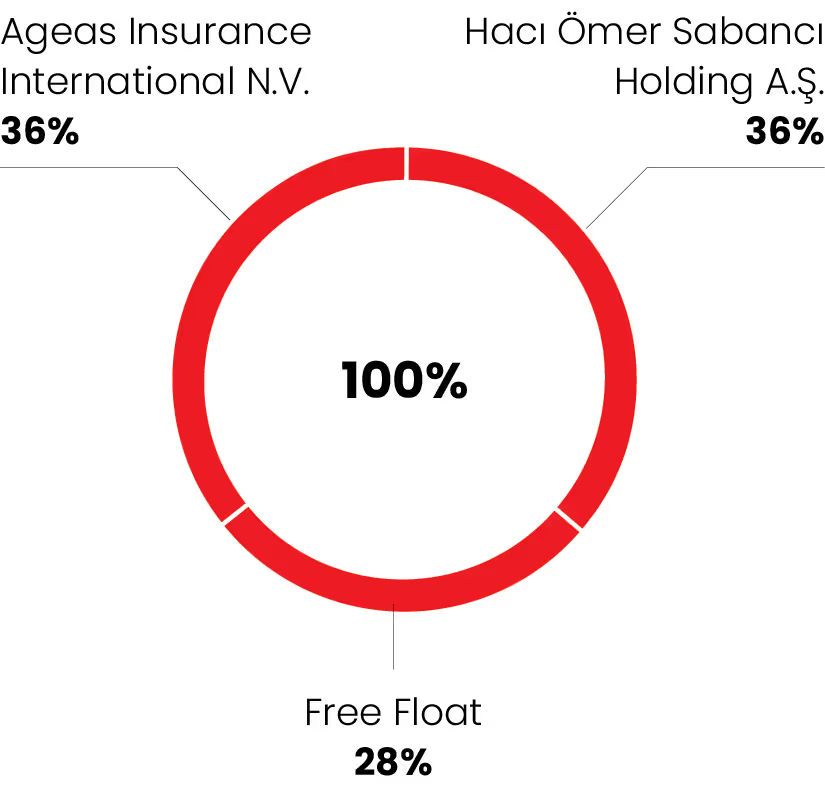

Aksigorta Partnership Structure

Aksigorta Partnership Structure

Aksigorta continues its activities with a 36%-36% partnership between Sabancı Holding and Ageas Insurance International NV.

Registered Capital

Aksigorta A.Ş. changed to the registered (authorized) capital system pursuant to the provisions of Türkiye’s Capital Market Law (Statute 2499) as of 9 March 1995 and holds license number 301 from the Capital Markets Board. The Company’s authorized capital ceiling is TL 3,000 million, and its paid-in capital is TL 1,612 million as stated in the permit letter of The Ministry of Commerce General Directorate of Domestic Trade dated 29 July 2024 and numbered E-50035491-431.02-00076805481 and as stated in the permit letter of Capital Markets Board dated 1 July 2024 and numbered E-29833736-110.03-03-23502.

Capital Structure

No material changes have taken place in the capital structure of Aksigorta A.Ş., as shown in the table below. Both of the Company’s major shareholders purchased the same volume of Aksigorta shares traded on the Borsa Istanbul; as a result, their stake in the Company increased from 33.11% to 36% in 2012. None of the real partners have qualified share in the partnership structure.

Management Methodology

Aksigorta continues its activities as a joint venture company with a 36%-36% partnership between Sabancı Holding and Ageas Insurance International NV.

Shareholders that Control more than a 10% Stake in the Company’s Issued Capital

The names and shareholding interests of shareholders who hold more than a 10% stake in the Company’s issued capital are shown in the chart:

Tablonun devamı için sağa kaydırın

| December 31, 2023 | December 31, 2023 | December 31, 2022 | December 31, 2022 | |

| Shareholders | Share (%) | Amount (TL) | Share (%) | Amount (TL) |

| Hacı Ömer Sabancı Holding A.Ş. | 36 | 580,320,000 | 36 | 580,320,000 |

| Ageas Insurance International N.V. | 36 | 580,320,000 | 36 | 580,320,000 |

| Free Float | 28 | 451,360,000 | 28 | 451.360.000 |

| Total | 100 | 1,612,000,000 | 100 | 1,612,000,000 |